Managing finances for military families can be uniquely challenging due to the demands of military life. Deployments, frequent moves, and fluctuating income can make budgeting and saving difficult. However, with the right guidance, military families can develop effective strategies for financial security. Budgeting tips include understanding all sources of income, tracking expenses, creating a spending plan, and setting clear financial goals. Saving tips include automating savings, utilizing military benefits, cutting back on non-essential spending, and shopping smart. Additionally, there are resources available such as the Personal Financial Management Program, Military Relief Societies, and online tools and resources to assist military families in budgeting and saving. By implementing these strategies and utilizing available resources, military families can work towards a secure financial future.

Financial Guidance for Military Families: Budgeting and Saving Tips

Introduction

Managing finances can be challenging for any family, but for military families, the unique demands of military life can make it even more difficult. Deployments, frequent moves, and the possibility of sudden changes in income can all add to the complexity of managing money. However, with the right guidance and resources, military families can develop effective budgeting and saving strategies to secure their financial future.

Budgeting Tips

Creating and sticking to a budget is essential for military families to manage their finances effectively. Here are some budgeting tips for military families:

- Understand Your Income: Military families often receive income from various sources, including base pay, housing allowances, and special pay. It is important to have a clear understanding of all sources of income to create an accurate budget.

- Track Expenses: Keep track of your family’s expenses, including bills, groceries, transportation, and other everyday spending. This can help identify areas where you can cut back and save money.

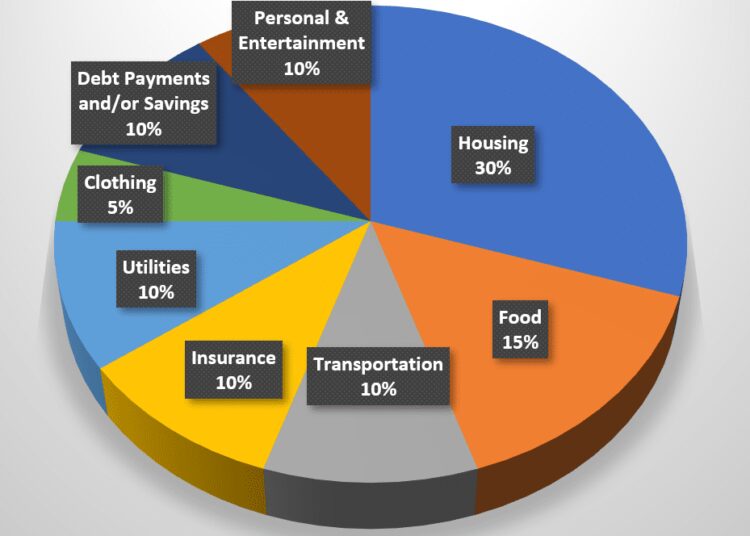

- Create a Spending Plan: Allocate specific amounts of money for different categories such as housing, food, transportation, and entertainment. This can help you prioritize expenses and control overspending.

- Set Financial Goals: Whether it’s saving for a home, paying off debt, or building an emergency fund, setting clear financial goals can help guide your budgeting decisions.

Saving Tips

Creating a habit of saving is important for military families to build financial security. Here are some saving tips for military families:

- Automate Savings: Set up automatic transfers to a savings account so that a portion of your income is saved before you have a chance to spend it.

- Take Advantage of Military Benefits: Military families have access to special savings programs, such as the Thrift Savings Plan (TSP) and the Military Savings Deposit Program (SDP). Take advantage of these programs to maximize your savings.

- Cut Back on Discretionary Spending: Cut back on non-essential expenses such as dining out, shopping, and entertainment to free up more money for savings.

- Shop Smart: Look for discounts and deals, and consider buying in bulk or using coupons to save on everyday items.

Financial Guidance Resources for Military Families

There are various resources available to military families to help them with budgeting and saving. These include:

- Personal Financial Management Program: Many military installations offer free financial counseling and workshops to assist military families with budgeting, debt management, and savings strategies.

- Military Relief Societies: Organizations such as the Army Emergency Relief (AER), Navy-Marine Corps Relief Society (NMCRS), and Air Force Aid Society (AFAS) offer emergency financial assistance and financial counseling to military families in need.

- Online Tools and Resources: There are numerous online resources and tools available to help military families with budgeting and saving, such as budgeting apps, financial calculators, and educational materials.

Conclusion

Managing finances is a crucial aspect of maintaining stability and security for military families. By implementing effective budgeting and saving strategies, and taking advantage of available resources, military families can navigate the challenges of military life while working towards a secure financial future.